The American Dream Experience® Is a Breakthrough Financial Training Where You Can Discover:

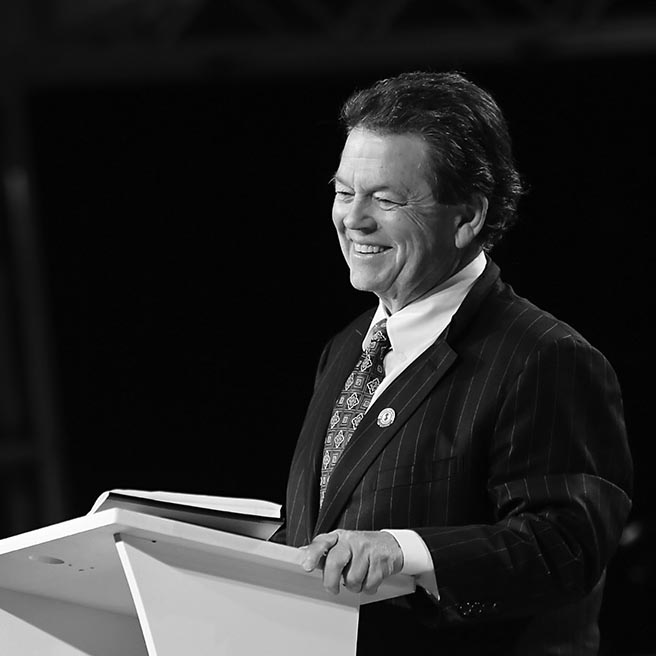

Meet Mark Matson.

An American entrepreneur, author, and innovator in the fields of investing science and financial education. He is the creator of educational experiences, platforms, and tools that can make Nobel Prize-winning1 investing research accessible to investors and can transform their relationship to money. Most notably, he is the creator of The American Dream Experience and the Matson Method.

Harry M. Markowitz, Ph.D.

Arthur B. Laffer, Ph.D.

Terrance Odean, Ph.D.

Savina Rizova, Ph.D.

R. Lyman Ott, Ph.D.

David Eagleman, Ph.D.

Legacy Member - 2018-2023 Harry Markowitz received the Nobel Prize for Economics in 1990 for his contributions to financial economics. Markowitz developed the foundations of Modern Portfolio Theory in the 1950s, which demonstrates how an investment portfolio can be engineered to maximize return for any given level of risk. This work included the Markowitz Efficient Frontier which allows individual investors to understand how a portfolio’s expected returns vary with the amount of risk taken for a given combination of asset classes. In 1989, Dr. Markowitz was awarded the John Von Neumann Theory Prize in Operations Research Theory from the Operations Research Society of America and the Institute for Operations Research and Management Sciences (‘INFORMS’) for contributions in portfolio theory, sparse matrix methods, and simulation language programming. Markowitz taught economics at Baruch College at the City University of New York, from 1982 until 1993, where he was a Distinguished Professor Emeritus. He engaged as an Adjunct Professor at the Rady School of Management at the University of California, San Diego; as well as Principal of Harry Markowitz Company. Since its inception, the Matson Method of portfolio construction has been based on strong scientific investing principles, enabling us to provide advisors and investors alike an investing methodology that aligns with their long-term financial goals and is sensitive to their risk tolerance. Undoubtedly, essential to these principles is Markowitz’s Modern Portfolio Theory, which we assert will continue to still work for generations to come so they can have peace of mind around their money.

Dr. Laffer’s economic acumen brings a distinct advantage to Matson Money, our coaches, and clients with insights on the implication of economic policy on savers and investors. Frequently referred to as “The Father of Supply-Side Economics,” Dr. Laffer helps navigate the complexities of the economy, interest rates, and tax efficiency as it applies to portfolio construction.

Terrance Odean is a leader in the field of behavioral finance, boasting extensive research in the area of investor behavior, investor biases and habits. His research reveals how behavior can destroy investor performance and the ability to create wealth. Dr. Odean’s expertise is essential to the creation of coaching systems and tools for prudent long–term investing.

Savina Rizova currently serves as Dimensional Fund Advisor’s Co-Chief Investment Officer and Global Head of Research. In her role at Dimensional, she applies her background in finance to a wide variety of research projects to help improve every step of the investment process, from research on drivers of returns to portfolio design, portfolio management, and trading. In addition, Savina leads the efforts of the Research group to provide thought leadership to clients and prospects on important investment-related topics. During her undergraduate studies at Dartmouth College, she served as a research assistant to Professor Kenneth French.

As an expert in the field of statistics, Dr. Ott lends his expertise to Matson Money and investors by actively analyzing and providing third-party validation for the economic and financial research upon which our portfolios are constructed. His scrutiny indicates the probability of outcomes concerning the implementation of specific investing strategies. His analysis of the existence and confirmation of “The Barbell Effect” has a significant impact on the design of Matson Money portfolios.

David Eagleman is a neuroscientist at Stanford University, an internationally bestselling author, and a Guggenheim Fellow. He is the writer and presenter of The Brain, an Emmy-nominated television series on PBS and BBC. Dr. Eagleman’s areas of research include sensory substitution, time perception, vision, and synesthesia; he also studies the intersection of neuroscience with the legal system, and in that capacity he directs the Center for Science and Law. Eagleman is the author of many books, including Livewired, The Runaway Species, The Brain, Incognito, and Wednesday is Indigo Blue. He is also the author of a widely adopted textbook on cognitive neuroscience, Brain and Behavior, as well as a bestselling book of literary fiction, Sum, which has been translated into 32 languages, turned into two operas, and named a Best Book of the Year by Barnes and Noble. Dr. Eagleman writes for the Atlantic, New York Times, Discover Magazine, Slate, Wired, and New Scientist, and appears regularly on National Public Radio and BBC to discuss both science and literature. He has been a TED speaker, a guest on the Colbert Report, and profiled in the New Yorker magazine. He has spun several companies out of his lab, including Neosensory, a company which uses haptics for sensory substitution and addition.

Statistics

Facts & Figures as of November, 2025

$12.06 Billion

In Assets Under Management

Over 29,000 Investors

Representing all 50 US States and Puerto Rico

27,000+ Holdings

In 78 countries for true global diversification3

500+ Financial Advisors

From Alaska to Texas

What We Stand For.

Our Values

DO YOU ALIGN WITH THESE VALUES?

JOIN US AT THE AMERICAN DREAM EXPERIENCE December 17th

Integrity

We are our word.

Entrepreneurial Spirit

Our unwavering commitment to innovation, creativity and service.

Education & Inquiry

The continuous pursuit of financial academic theory. Being the leader in the application of empirically tested Nobel Prize-winning investing principles.

Training & Development

Transforming investors to be prudent and disciplined throughout an entire lifetime.

Capitalism

We are a stand that a free market pricing system inspires competition, innovation and wealth creation.

Join Us for an Event That Could Change Your Life.

Don't wait. Discover the Science of Investing. Take the plunge and register today.

This is not an offer of sale of securities.

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or an offer to provide advisory or other services by Matson Money in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained on this website should not be construed as financial or investment advice on any subject matter.

THIS WEBSITE MAY CONTAIN TESTIMONIALS OR VIDEOS OF TESTIMONIALS.

Matson did not provide cash compensation to the testimonial providers for their participation in the testimonials. Attendees of the American Dream Experience, including the testimonial providers presented, attended free of charge, received branded products such as clothing, notebooks and pens and are provided with meals. Matson is not aware of any material conflicts of interest resulting from the relationship between Matson and the testimonial providers as no cash compensation was provided and Matson does not believe the branded products or meals were of the type or value to potentially create a material conflict of interest.

1. NOBEL PRIZE WINNING ACADEMIC

www.nobelprize.org

The Nobel Memorial Prize in Economic Sciences, commonly referred to as the Nobel Prize in Economics, is an award for outstanding contributions to the field of economics, and generally regarded as the most prestigious award for that field.

Markowitz, Harry. "Portfolio Selection." Journal of Finance. 1952.

Harry Max Markowitz is an American economist, and a recipient of the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences. Markowitz is a professor of finance at the Rady School of Management at the University of California, San Diego.

Efficient Market Hypothesis, first explained by Dr. Eugene Fama in his 1965 doctoral thesis.

Eugene F. Fama, "Random Walks in Stock Market Prices," Financial Analysts Journal, September/October 1965.

Eugene F. Fama, 2013 Nobel laureate in Economic Sciences; is widely recognized as the "father of modern finance." His research is well known in both the academic and investment communities. He is strongly identified with research on markets, particularly the efficient markets hypothesis.

2. Academic Board Disclosure

Academic Advisory Board members receive compensation from Matson Money for their services which include, but are not limited to, independent leadership consulting; co-authoring white papers; and speaking at Matson Money conferences. Advisory Board members may also provide insight to Matson Money on portfolio construction, asset allocation, quantitative analysis, investor behavior and other areas of expertise, as needed. Certain Advisory Board members are employed by or otherwise affiliated with third party advisory firms that offer funds in which Client accounts are invested.

3. Holdings Disclosure

Fund of Funds Risk. The investment performance of client portfolios is affected by the investment performance of the underlying funds in which the portfolio is invested. The ability of the total client portfolio to achieve its investment objective depends on the ability of the underlying Matson-advised mutual funds to meet their investment objectives, on Matson's decisions regarding the allocation of the portfolio's assets among the underlying Matson-advised mutual funds, and on Matson's decisions regarding investments made by the underlying Matson-advised mutual funds. The portfolio may allocate assets to an underlying fund or asset class that underperforms other funds or asset classes. There is no assurance that the investment objective of the portfolio or any underlying fund will be achieved. When the portfolio invests in underlying funds, investors are exposed to a proportionate share of the expenses of those underlying funds in addition to the expenses of the portfolio. Matson may receive fees both directly on your account as well as on the money your account invests in the underlying funds, and the underlying funds themselves may bear expenses of the mutual funds or ETFs in which they invest. Through its investments in the underlying funds, the portfolio is subject to the risks of the underlying funds' investments, with certain underlying fund risks described later in this presentation. More information on mutual funds, ETFs, and associated fees, is available in fund prospectus documents, available online at: http://funddocs.filepoint.com/matsonmoney/.

References to Holdings

Due to Matson's investment philosophy and methodology, any references by Matson or by unaffiliated third parties to specific holdings, number of holdings, or specific countries or asset classes are references to the underlying funds in which the Matson-advised mutual funds invest. Mutual funds currently use SEC Forms N-PORT and N-CSR to disclose their quarterly holdings at the end of each fiscal quarter (Form N-PORT replaced Form N-Q),therefore any specific holdings cited are accurate as of that date or is data provided directly by the underlying fund company itself, and do not in any way represent portfolio management research or trading decisions made by Matson Money, other than to the extent Matson Money has allocated Matson-advised mutual fund investments to such underlying funds. Form N-PORT can be found online at https://www.sec.gov/Archives/edgar/.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

This website is not to be considered investment advice and is not to be relied upon as the basis for entering into any transaction or advisory relationship or making any investment decision.

4. Description of Matson Money, Inc.

This content is not to be considered investment advice and is not to be relied upon as the basis for entering into any transaction or advisory relationship or making any investment decision.

Matson Money, Inc. “Matson” is a federally registered investment advisor with the Securities Exchange Commission (“SEC”) and has been in business since 1991. In Canada, Matson is registered as a portfolio manager in Ontario, Alberta, and British Columbia. Registration with the SEC and the Canadian securities regulatory authorities does not imply their approval or endorsement of any services provided by Matson. This content is based on the views of Matson. The concepts discussed herein are for educational purposes only. This content includes the opinions, beliefs, or viewpoints of Matson Money and its Co-Advisors and should not be relied upon for entering into any transaction, advisory relationship, or making any investment decision. Other organizations or persons may analyze investments and the approach to investing from a different perspective than that reflected in this content. Nothing included herein is intended to infer that the approach to investing discussed in this content will assure any particular investment result.

All of Matson Money’s advisory services are marketed almost exclusively by either Solicitors or Co-Advisors (“Promoters”). The term “Co-Advisor” is equivalent in meaning to the term “Promoter.” Co-Advisors are either unaffiliated separately registered investment advisors, or registered representatives and/or investment advisor representatives of unaffiliated dual registrant brokerage firms. Matson is not affiliated with the Co-Advisors or the firms with which they are associated. Each Co-Advisor enters into a contractual agreement to serve as a non-discretionary Co-Advisor with respect to clients referred by the Co-Advisor to Matson. Solicitors typically do not enter into investment management agreement with clients. Both Co-Advisors and Solicitors have similar responsibilities including promoting and referring clients, and client coaching, including maintaining suitability information, routine service issues, and relationship management. All Co-Advisors are independent contractors, not employees or agents of Matson. Co-Advisors are paid fees as set forth under the tri-party Investment Management Agreement. Such fees are negotiable and may range from .20% to 1.2% of Account Owner assets under management. Matson does not retain any portion of these fees and is compensated only through advisory fees embedded in the Matson Funds.

The Co-Advisor receives an annual fee, paid quarterly in advance by Matson, based on total assets under management of the Co-Advisor’s clients. Generally, the greater the assets under management that the Co-Advisor’s clients have, the higher their annual compensation will be. Due to this compensation arrangement, the Co-Advisor has a financial incentive to promote Matson in lieu of other financial services providers, which results in a material conflict of interest.

Account Owners referred by other Co-Advisors may pay lower advisory fees for comparable services as a result of the range of fees available at each asset level breakpoint.

Co-Advisor’s fee may be paid directly by Account Owner to Co-Advisor or this fee may be deducted from Account Owner’s account by Matson and paid by Matson to Co-Advisor. No part of this fee is retained by Matson. The Co-Advisor's relationship with Matson, including fees payable from the Account Owner’s Account, is governed by a separate agreement between Matson and the Co-Advisor. The nature of this relationship creates an inherent conflict of interest.

Additionally, Co-Advisors who have entered into a Co-Advisory Agreement with Matson Money can also choose to enroll in the Matson Money Brand Ambassador program under an additional separate Brand Ambassador Agreement with Matson Money. A Brand Ambassador can use Matson’s Licensed Marks in connection with the operation of its business as an investment advisor, and Matson grants the Brand Ambassador a license to use the Licensed Marks, subject to the terms and conditions of the Agreement. In addition, the Brand Ambassador retains Matson to provide certain operational consulting services in connection with the Brand Ambassador’s business operations and use of the Licensed Marks, and provides such Operational Consulting Services which includes additional training and coaching, subject to the terms and conditions of the Agreement. Matson Money receives compensation for the Brand Ambassador arrangement of approximately $100,000 to cover the cost of creating branded assets like films, presentations, logos, and other various marketing material, as well as additional services like in-depth training and coaching for leading the American Dream Experience. Some additional expenses can be charged for additional services.

In Canada, Matson acts as a sub-advisor to another registered portfolio manager (“Advisor”). Matson is not affiliated with the Advisor. The Advisor and Matson have entered into a sub-advisory agreement, under which Matson has agreed to sub-advise client accounts managed by the Advisor. Client accounts are invested in strategies managed by Matson. The Advisor is responsible for client onboarding and account opening collection of know-your-client information and suitability determination and overall client relationship management.

All investing involves risks and costs. These risks may not always be mitigated through long-term investing or diversification. Your advisor can provide you with more information about the risks and costs associated with specific programs. Your advisor is not affiliated with Matson Money, Inc. The information contained in this content is for educational purposes only and is not intended as investment advice. No investment strategy (including asset allocation and diversification strategies) can ensure peace of mind, guarantee profit, or protect against loss.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

Copyright © 2025 Matson Money, Inc.